Divergence at its Peak

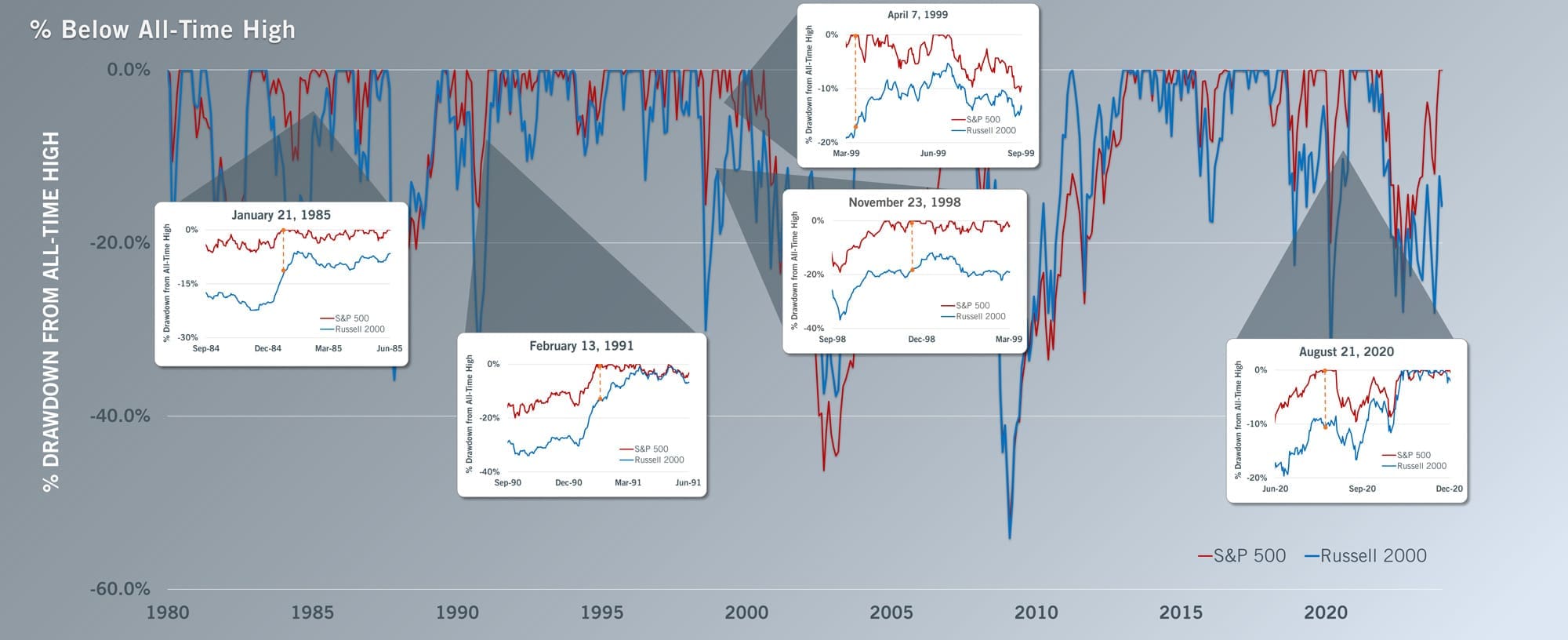

What happens when the S&P 500 hits an all-time high but, simultaneously, the Russell 2000 is in massive decline? We examine the historical trends and what it could mean for stocks this time around.

On Friday, January 19, 2024, the S&P 500 soared to an all-time high, marking the continued success of large cap stocks. Simultaneously, as the S&P hits its new high, the Russell 2000 Index, which represents small cap U.S. equities, experienced its biggest decline ever.

Looking back at the market’s behavior during the previous five instances of major divergence between the S&P 500 highs and the Russell 2000 corrections reveals an interesting pattern:

| R2000 Max Drawdown When S&P 500 Reaches All-Time High | ||||

| R2000 Max Drawdown |

Date of S&P 500 All-Time High |

R2000 % off of Previous All-Time High |

S&P 500 Performance Over the Next 12 Months |

R2000 Performance Over the Next 12 Months |

| January 19, 2024 | -20.4% | ? | ? | |

| 1st Largest | April 7, 1999 | -19.2% | 14.3% | 36.4% |

| 2nd Largest | November 23, 1998 | -19.1% | 18.2% | 14.1% |

| 3rd Largest | February 13, 1991 | -13.4% | 12.1% | 35.4% |

| 4th Largest | January 21, 1985 | -13.3% | 17.4% | 18.2% |

| 5th Largest | August 21, 2020 | -10.8% | 31.9% | 42.2% |

| Average | 18.8% | 29.3% | ||

Source: Bloomberg

In each of these previous instances, both indices eventually rallied, with the Russell 2000 not only recovering but significantly outperforming the S&P 500 over the subsequent 12 months. This pattern suggests a compelling cycle of market corrections and rebounds, where initial disparities set the stage for robust rallies in both large and small cap stocks, albeit with small caps leading the charge.

IMPLICATIONS OF THE DIVERGENCE – TWOFOLD

While the immediate reaction might be to favor the soaring large cap stocks, historical trends advocate for a more balanced view, especially for those looking towards long-term gains. The Russell 2000’s dramatic drawdown, juxtaposed with the S&P 500’s peak, hints at potential undervaluation in the small cap space, suggesting that opportunities for growth may be lurking down cap. For investors willing to navigate the volatility, the past suggests that the small cap underperformance is temporary, with significant upside potential in the year following such disparities.

As we analyze this historic divergence, it’s crucial for investors to look beyond the immediate contrasts and recognize the cyclic nature of markets. History teaches us that today’s disparities can be tomorrow’s opportunities, particularly for those who are vigilant and patient. The resilience of small cap stocks, as evidenced by their ability to bounce back and outperform following periods of significant drawdowns, underscores the importance of diversification and a long-term perspective in investment strategies.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.