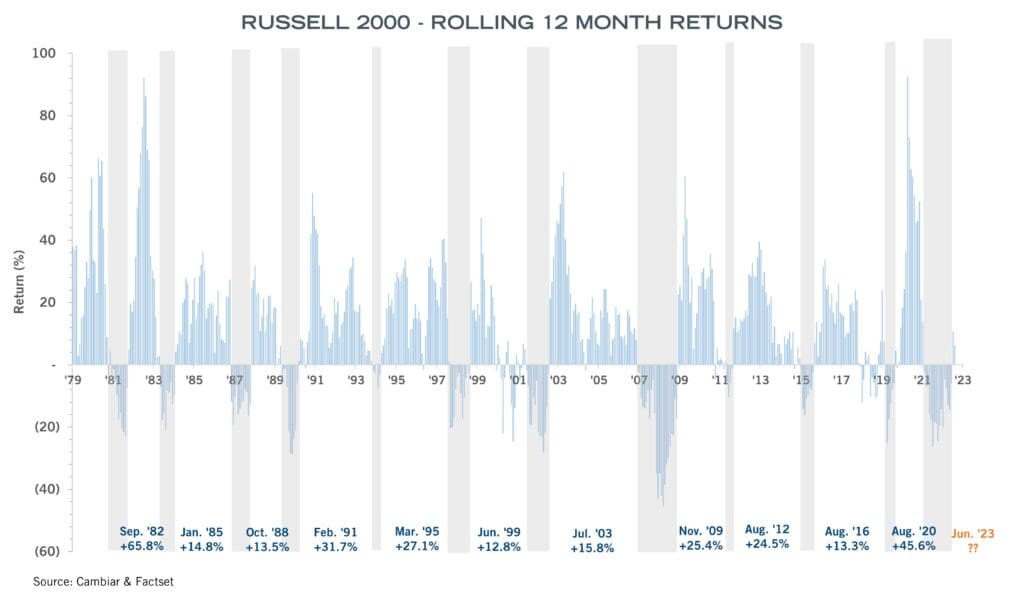

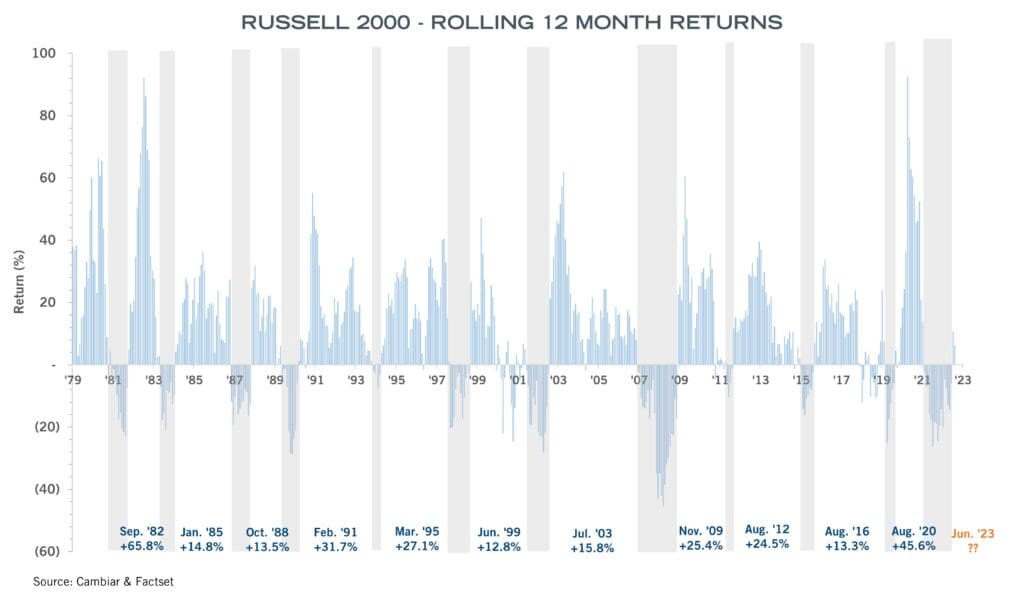

Since 1980, the Russell 2000 Small Cap Index has experienced 12 “streaks” where rolling 12-month returns were negative for at least four consecutive months (shaded below). The latest period just ended in June 2023.

Index returns do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

For the first 11 occurrences, following the end of the negative rolling periods, the average one–year return for small cap stocks was over 26%. The latest streak ended in June 2023 and so far is trending similarly to the previous 11 occurrences.

Russell 2000 – Streak of Consecutive Months With

Negative Rolling 12-Month Return |

| Streak Start |

Streak End |

Streak Length

(Months) |

12-Month Return Post Streak End |

| Nov-81 |

Sep-82 |

10 |

65.8% |

| Apr-84 |

Jan-85 |

9 |

14.8% |

| Oct-87 |

Oct-88 |

12 |

13.5% |

| Apr-90 |

Feb-91 |

10 |

31.7% |

| Oct-94 |

Mar-95 |

5 |

27.1% |

| Aug-98 |

Jun-99 |

10 |

12.8% |

| May-02 |

Jul-03 |

14 |

15.8% |

| Nov-07 |

Nov-09 |

24 |

25.4% |

| Apr-12 |

Aug-12 |

4 |

24.5% |

| Dec-15 |

Aug-16 |

8 |

13.3% |

| Feb-20 |

Aug-20 |

6 |

45.6% |

| Jan-22 |

Jun-23 |

17 |

? |

| Average 12-Mo Return Post Streak End |

26.4% |

Source: Bloomberg

Index returns do not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Could this be the latest positive inflection point for small cap stocks?

At Cambiar, we remain quite optimistic about the current macro backdrop for small cap businesses. Combining these observations with our focus on investing in high-quality franchises at attractive valuations and company-specific fundamentals, we believe that this is a time for investors to consider an actively managed portfolio like the Cambiar Small Cap strategy.

Disclosures

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication

Mutual fund investing involves risk, including the possible loss of principal. In addition to the normal risks associated with investing, investments in smaller companies typically exhibit higher volatility. There can be no assurance that the Fund will achieve its stated objectives.

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Fund’s summary or statutory prospectus which can be obtained by clicking here or calling 1-866-777-8227. Please read it carefully before investing.

This material represents the portfolio manager’s opinion and is an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice or a specific recommendation of securities. There is no guarantee that any forecasts made will come to pass.

Cambiar Funds are distributed by SEI Investments Distribution Co., 1 Freedom Valley Dr. Oaks, PA 19456, which is not affiliated with the Advisor. Cambiar Funds are available to US investors only. Strategies included within the Separate Account section are not mutual funds and are not affiliated with SEI Investments Distribution Co.