Domestic Markets – 2Q20 Review

The ‘gro-mo’ trade (growth and momentum) has reached a level where Nasdaq stocks are outperforming the broader market by magnitudes last seen in the dotcom bubble.

Financial assets rose in unison during the second quarter – with stocks, bonds and commodities all notching strong gains. Within the U.S. equity markets, the S&P 500 Index climbed 20.5%, while the smaller-cap Russell 2000 Index posted a 25.4% return. On a style basis, growth stocks remain firmly in the driver’s seat – a trend that has been in place for much of the current cycle, but has been exacerbated in the current pandemic environment. The ‘gro-mo’ trade (growth and momentum) has reached a level where Nasdaq stocks are outperforming the broader market by magnitudes last seen in the dotcom bubble. Granted, many tech companies today have real revenues and earnings, but implied valuations are approaching euphoric levels.

After providing a margin of downside protection in the first quarter, Cambiar’s domestic strategies outperformed their respective passive benchmarks to the upside in the second quarter. The ability to perform well in two very different market environments has largely been a function of attaching to quality companies that can not only see through, and past, the current uncertainty, but can also be in a position to take market share as business conditions normalize.

In Cambiar’s first quarter commentary, we noted that event-driven bear markets such as the one that took place in 1Q often take on a ‘faster in/faster out’ profile. That said, the shift in investor sentiment from one of fear to one of missing out was certainly much quicker than expected – with an approximate 45% rally in the S&P 500 from the March bottom to early June. Stocks subsequently weakened into quarter-end in response to a re-intensifying of COVID-19 cases and corresponding delays to small business re-opening schedules.

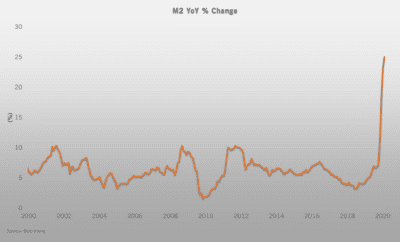

As we reach the halfway point of 2020, the S&P 500 Index has returned -3.1%. Given the pandemic-induced collapse in economic activity and resulting rise in unemployment, this modest pullback in the equity market speaks to the continued resiliency of risk assets. As has been the case for most of the current cycle, any decline in stocks has been an opportunity to buy – and the drawdown in March was no exception. While factors such as oversold market conditions and progress on a COVID-19 vaccine contributed to a portion of the second quarter gains, Cambiar views the massive expansion in money supply to be the primary upward catalyst for stock prices in 2Q. The rise in money supply is illustrated in the graph.

As we reach the halfway point of 2020, the S&P 500 Index has returned -3.1%. Given the pandemic-induced collapse in economic activity and resulting rise in unemployment, this modest pullback in the equity market speaks to the continued resiliency of risk assets. As has been the case for most of the current cycle, any decline in stocks has been an opportunity to buy – and the drawdown in March was no exception. While factors such as oversold market conditions and progress on a COVID-19 vaccine contributed to a portion of the second quarter gains, Cambiar views the massive expansion in money supply to be the primary upward catalyst for stock prices in 2Q. The rise in money supply is illustrated in the graph.

In aggregate, an extraordinary amount of uncertainty regarding the forward economic outlook is being countered by an extraordinary monetary (and fiscal) response. And unlike the 2008-2009 financial crisis, the monetary transmission mechanism in the current market is very much intact; as such, the Fed’s money supply explosion has quickly made its way into the real economy…and asset prices.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation. Securities highlighted or discussed have been selected to illustrate Cambiar’s investment approach and/or market outlook. The portfolios are actively managed and securities discussed may or may not be held in client portfolios at any given time, do not represent all of the securities purchased, sold, or recommended by Cambiar, and the reader should not assume that investments in the securities identified and discussed were or will be profitable.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts are based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.