Tariffs, Rhetoric, and Reality: Navigating Market Uncertainty

In this Q&A roundtable, Cambiar’s Portfolio Managers break down the potential impact of Trump’s latest tariffs and the global retaliation to follow.

In this Q&A roundtable, Cambiar’s Portfolio Managers—Brian Barish (Large Cap), Di Zhou (International), and Colin Dunn (Small/SMID)—break down the potential impact of Trump’s latest tariffs and the global retaliation to follow. With political rhetoric creating market noise, how are they navigating the uncertainty? From supply chain shifts to valuation opportunities, our investment leaders discuss how they’re positioning their portfolios amid the latest trade tensions.

How could the imposed tariffs impact your portfolios?

Di Zhou – Analyzing the impact of trade tariffs on corporate earnings is more art than science. From a top-down perspective, analysts estimate about 37% of global sales (excluding financial services) in the MSCI ACWI Index are manufactured goods – of which 13% are exported to the U.S. The actual revenue exposure is likely substantially lower than 13%, given that a lot of companies have production facilities in the U.S. While we don’t necessarily anticipate that companies will change their manufacturing footprint or move their supply chains, there are a number of things that could be done to mitigate the earnings impact from tariffs. One is expense reductions in other segments of their business. Another option is for companies to share the pain with their customers via higher pricing. Within our International portfolio, we own a number of discretionary businesses that cater to higher income consumers, which makes it relatively easier to pass on cost inflation. The last option would be to absorb any leftover costs. On this front, we prefer to own companies that possess higher margin/return profiles, which allows them to absorb the negative impact from tariffs vs. companies with lower margins.

It is also worth noting that a stronger U.S. dollar would provide a natural offset to tariff headwinds. In aggregate, it is difficult to assess earnings risk without knowing the details of tariffs. Our current working assumption is that the earnings impact should be manageable for our companies. That said, there is clearly a scenario that could be more onerous, so we certainly don’t want to be complacent about it.

Brian Barish – It would depend on the actual tariff levels and breadth of them. Do they apply to all imports, or are they more targeted? We have heard in a few corners to expect a 3% global tariff (on all imports) and something punitive, such as a 30% rate, for countries that are considered hostile to the U.S. That may or may not include China, that’s hard to say right now.

We are not going to operate as though we know this is the end game, but it does sound plausible. For now, we don’t see why our portfolio would need to be reconfigured. Most countries that export substantially to the U.S. do so because of their competitive position, such as electronics from Asia or commodities from the Americas. A moderate tariff won’t change that.

My own view on Trump is that he indeed does not hold any attachment for the prevailing world order (which is a WTO-driven version of mostly free trade) and seems confident that he can re-negotiate most of this on more favorable terms. Introducing some chaos to the equation by way of tariff threats is his way of forcing the issue. But in many cases, I am unclear where he intends to end up.

Colin Dunn – On the negative side, the announced tariffs are likely to impact the direct input costs or selling prices for owned company products if delivered from overseas. The evolving and volatile tariff policy could also more broadly insert uncertainty into the operating environment, suppressing near term demand. To the extent these policies are near-term supportive to the U.S. Dollar, there could also be some translation headwinds as revenue and earnings are under pressure.

While most companies are more likely to see a headwind from tariffs, it is possible one of the intended consequences of the policies—U.S. on-shoring—could spawn an investment cycle that drives demand, beneficial to a minority of companies.

What areas of the market/economy stand to be the most impacted for the better/worse from the proposed changes in trade policies?

BB – Given the extent to which global supply chains are intertwined, if there is a global tariff on everything set at a high level, it would be damaging to any number of American manufacturing or consumer-facing businesses. That would, in turn, be growth-negative for the U.S. and world economy. We would expect long-term interest rates to decline if this transpired, which would damage the business case for rate-sensitive financials to an extent.

CD – Companies that serve the U.S. market from production outside the U.S. are likely among the most impacted. Autos are often flagged as the most impacted, as the process of building a car for the U.S. market requires auto parts to travel back and forth across the Mexican and Canadian borders multiple times.

Many consumer discretionary companies are also impacted, as a lot of apparel is produced abroad, particularly in Asia.

Recent tariffs on base metals are also likely to increase the production costs of large manufactured goods that use these metals as a significant input. The price of steel is up 11% in just the last couple of weeks, reflecting the prospect of a more insulated, less competitive U.S. market. Automobiles again stand out as being impacted, but many other industrial goods consume steel and aluminum and could face higher costs.

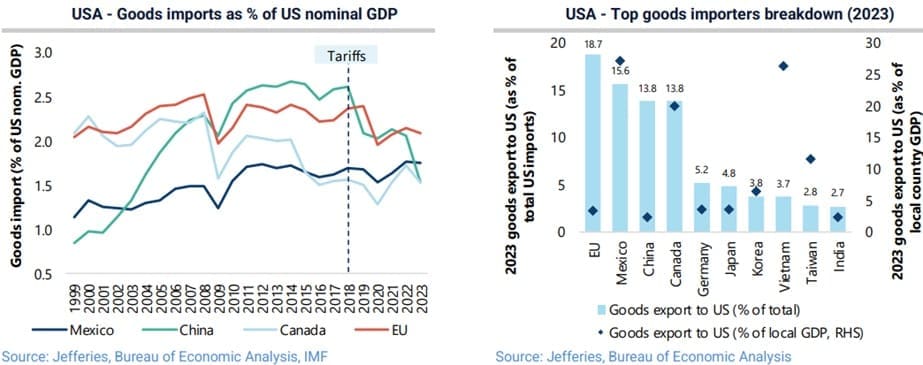

DZ – While goods exports from China and EU have reduced significantly since the first trade war from 2018 to 2020, EU, Mexico, China, and Canada remain to be the top exporting countries to the U.S. It is not surprising then that the current tariff headlines involve those countries. However, nominal trade deficit doesn’t mean those countries are most impacted by US tariffs. Economies which are most leveraged to goods exports to the US are most vulnerable; examples here include Mexico, Canada, and Vietnam. Among sectors, tech hardware, automotives, food & beverages, pharmaceuticals, and cap goods are most exposed.

With U.S. and international stocks positive for the year, are you surprised that the market has thus far looked past growth-negative policies such as tariffs and immigration reform?

BB – President Trump appears to be predominantly a “transactionally motivated” politician who likes to use the threat of tariffs to induce a transactional negotiation, i.e., a “deal”. This is, to some extent, a consensus view, meaning that markets perceive most proposed tariffs as negotiable bargaining chips the minute they are proposed, and reactions are muted thus far.

We have seen proposed tariffs of 25% on Canadian and Mexican imports immediately postponed in favor of promises for extensive cooperation in controlling illegal immigration and drug trade. We expect to see more such trial balloon headlines and subsequent negotiations. We don’t know where these will settle out, but (it would seem) a re-negotiation of NAFTA is forthcoming, which would include codifying U.S. expectations for immigration and illicit drug trade into the trade agreement.

With respect to immigration, this is not about pure economics at this juncture, but a consequence of recent and longer-term political dysfunction and priorities. There’s no question that present day immigration laws and border security ought to be comprehensively reformed, but a legislative solution has eluded several Presidents from both parties over the last ~30 years. The decision to practically shut down border security and immigration enforcement with little explanation to the overall citizenry were among the most bizarre and inexplicable policies of the Biden Presidency. The backlash under Trump does not appear to be a transactionally-motivated policy, like tariffs. Rather, it will attempt to undo much of the immigration policy laxity. Replacing a loose border with a tight one and deporting illegal immigrants is not “growth positive,” but there may be some offset in improved consumer confidence among lower income earners (not fearing being replaced by illegal immigrants). There are similar “no more open borders” movements afoot in Canada and much of Europe at this point.

Given the high concentration of the U.S. stock market in major technology and communications platforms – most of which embed a substantial multiple premium associated with AI becoming pervasive and transformative – the direction of U.S. stocks (as measured by the S&P 500 or Nasdaq) may be decidedly uncorrelated with the U.S. economy, interest rates, tax, or immigration policy developments. The rest of the world’s stock markets on balance are much cheaper on most financial metrics and don’t have nearly as much riding on the AI thesis. A poor global growth outlook due to high tariffs would thus be more impactful to varying economies around the world.

DZ – European equity markets trade at close to a record 40% discount to the U.S. stocks, based on forward P/E multiples. Tariff-exposed stocks have already de-rated meaningfully vs. the European equity market in 2024 before President Trump was officially elected.

A lot of negatives (including trade tariffs) have been priced into the market. We think the strong year-to-date return for European stocks is driven by early signs of economic recovery in Europe, coupled with low valuations. We see a number of positive catalysts that could further drive EU equity markets higher: 1) ceasefire in Ukraine, 2) improving demand trends from China, 3) rate cuts by the European Central Bank (ECB), which would allow for housing/construction recovery; and 4) improving consumer confidence which would lead to a spend down of household savings. While we don’t want to underestimate headwinds from the rising global trade tension, progress of EU economic recovery is the key driver of equity markets in the near term.

Should investors expect more persistent volatility within your asset classes as a result of uncertainty around trade?

CD – I expect more volatility if visibility for trade and other policies does not stabilize soon, though I don’t yet see grounds for a meaningful halt to activity. Confidence surveys are already beginning to reflect some anxiety in the context of the rapid changes and musings to date. Consumer confidence usually impacts spending decisions, at least a little, and has begun to give back the initial post-election bump, according to the University of Michigan Survey. Business confidence has likely been more durable to date, given a more informed expectation for some of these announcements and excitement about a less onerous regulatory state, but I would not be surprised to see some delays in decision-making where policy certainty is required.

DZ – Yes, we will continue to experience headline risk on trade as President Trump could introduce new tariffs, reverse tariffs or double down on tariffs. The true economic impacts of trade tariffs are unclear at this point, given multiple moving parts. While it is difficult to forecast medium term economic growth, inflation, and central bank actions, what is more certain is the negative impact on consumer sentiment and business confidence. Even if tariff increases prove to be temporary because it is used as a negotiation tool for other agendas or it becomes too costly (economically and/or politically), we think businesses and consumers are likely to respond as if this is a permanent shock. We saw this in Trump’s first term, as CEO confidence dropped significantly from 2018 to 2020 – contributing to capital investment and hiring decisions and increased market volatility.

BB – On balance, I would say yes. If we are going to have “Tariff-o-Rama” every week for the next couple of years, that’s too much uncertainty and financial assets will need to embed higher risk premiums than they appear to presently. How should a technology or manufacturing company budget itself? Probably conservatively. Investors will reach a similar conclusion if this becomes un-forecastable from week to week, and price stocks more conservatively.

What changes – if any – are you considering within your respective portfolios?

BB – We were active in the 4th quarter in the Cambiar Large Cap Value strategy with respect to consumer, health care, and technology-oriented businesses – mainly buying the former and lightening up on the latter. Within technology, for the time being, the market’s focus has been on the build-out of the infrastructure to deliver AI as a broad service. Over time we expect to see this focus migrate to more downstream beneficiaries. We don’t exactly know what this will look like, but can imagine there will be some compelling applications. We are keeping our eyes open here.

There are two big geopolitical events inbound: U.S. tax and budgetary policy, and a resolution to the war between Russia and Ukraine. Both of these are on unsustainable paths and (it seems) will transition toward some new glide plane later in 2025. I don’t wish to speculate on global geopolitics, as it is indeed speculation versus an informed view. However, the outcome of these events may inform some or several portfolio actions over the coming year.

DZ – I don’t anticipate any significant changes in the International portfolio until we get clarity on policy. Trade tariffs were one of the most-discussed actions before President Trump was elected. As such, earnings downgrade risks are, to a certain degree, already priced into current valuations. Our Quality | Price | Discipline investment approach leads us to focus on companies with pricing power (to pass some costs on to customers), high margin/return (to absorb some margin headwinds), and strong balance sheets (ample capital to endure the difficult time or spend capex to make changes). While living with market volatilities is not ideal, volatility also brings opportunities. We continue to look for valuation dislocations and opportunities to own high quality companies that possess favorable risk/reward profiles.

CD – I do not anticipate any portfolio sales as a result of the policy announcements to date, but I do anticipate an ability to take advantage of market volatility to buy attractive businesses that are overly penalized around concerns amidst the evolving policies.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.