Key Benefits

Information Advantage

Small cap stocks have less analyst coverage and receive less attention from institutional investors compared to larger companies. This information asymmetry can create opportunities for active managers to uncover undervalued small cap stocks through their in-depth research and due diligence.

Performance Arbitrage

Active management in small cap stocks can aim to generate alpha, which is the excess return above the benchmark. The less efficient nature of the small cap market compared to larger cap stocks can provide opportunities for skilled active managers to identify mispriced securities and generate superior returns. Through careful stock selection, active managers can potentially outperform the market and deliver higher returns to investors.

Flexibility & Adaptability

As small cap companies tend to be more volatile, active managers have the advantage of making timely investment decisions based on new information, industry trends, and company-specific developments. They can take advantage of opportunities arising from events such as mergers and acquisitions, product launches, or regulatory changes.

Risk Management & Due Diligence

Small cap stocks often carry higher risk due to their size, liquidity constraints, and greater sensitivity to market conditions. Active managers can employ rigorous risk management strategies and conduct thorough due diligence to mitigate these risks. They can actively monitor portfolio holdings, assess corporate governance practices, analyze financial statements, and evaluate management teams to make informed investment decisions.

Selective Avoidance

A passive allocation to small caps in an asset allocation model is not nearly enough. The vast opportunity set and information inefficiencies within the asset class can enable seasoned, active managers like Cambiar to avoid pitfalls, pinpoint investable opportunities, and generate greater returns versus a passive index.

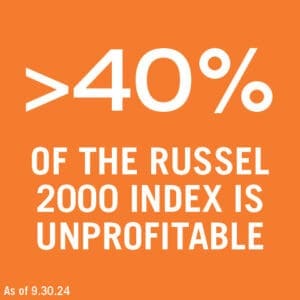

Non-Earners Within Russell 2000 Index

When analyzing the makeup of the Russell 2000 Index, a popular proxy for the small cap asset class, the percentage of companies that have no earnings has remained above 40%. With borrowing costs now significantly higher and inflation likely limiting the Fed’s ability for additional support, profitless companies with elevated debt levels may be particularly challenged.

Taking a passive approach to the asset class means consistent, elevated exposure to these lower-quality businesses.

Percent of Zombie Companies in the R2000 Index

Persistently low interest rates have translated into a low cost of capital, which has been a critical lifeline for many marginal companies. Many of these companies may not have been able to survive had they not been supported by unprecedented efforts from the Fed to bolster liquidity, allowing them to raise cash via cheap debt financing.

Note: “Zombie” company defined as companies with interest coverage ratio below zero. Source: FactSet/Russell

Downside of Passive

Investing in a small cap index can be a suitable investment strategy for certain investors, but there are potential drawbacks and considerations to keep in mind. Below are some reasons why investing solely in a small cap index may not always be the best option.

Protection Through Selective Avoidance

Sector concentration within the Russell 2000 Index is important to consider. The top five sectors make up 74% of overall index composition.

Heavy concentration combined with unprecedented flows into passive instruments can lead to crowding in securities with already elevated prices. An imbalanced exposure to these segments of the market without a rational understanding and reasoning of the underlying stocks is not a prudent approach.

As of 6.30.24

Lack of Selectivity

Concentration & Sector Bias

Cambiar

Small Cap Value

| Available Vehicles | CIT | Mutual Fund | Separate Account |

| Holdings Range | 45-55 Stocks |

| Market Cap | Primarily $500M – $5B |

| Mutual Fund Tickers | CAMSX (Investor Share Class) CAMZX (Institutional Share Class) |

| Inception Dates | Separate Account – 11/30/2004 CAMSX – 8/31/2004 CAMZX – 10/31/2008 |

In Focus

Explore our latest thought-leadership content focused on small caps.

Shifting Sands – Is It Time for Small Cap Value?

We explore the emerging trend of reallocating from large cap tech to small cap and value stocks. We examine the factors driving this shift and consider whether it marks the beginning of a longer-term rotation.

Election Years – Value vs. Growth

We examine the historical trend of value stocks outperforming growth stocks during election years, a pattern evident since 1980 and is particularly pronounced in small cap stocks.

Unearthing Hidden Gens: Navigating the Small Cap Landscape

In his latest interview, Cambiar Portfolio Manager Colin Dunn provides an update on the small and midcap landscape, highlighting intriguing investment areas.

A GUIDE TO INVESTING IN SMALL CAPS

We examine how investing in small cap stocks can offer several advantages over time, with unique opportunities for growth and long-term returns.

RISK DISCLOSURE

Mutual fund investing involves risk, including the possible loss of principal. In addition to the normal risks associated with investing, investments in smaller companies typically exhibit higher volatility. There can be no assurance that the Fund will achieve its stated objectives.

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the Fund’s summary or statutory prospectus which can be obtained by clicking here or calling 1-866-777-8227. Please read it carefully before investing.

This material represents the portfolio manager’s opinion and is an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice or a specific recommendation of securities. There is no guarantee that any forecasts made will come to pass.

Cambiar Funds are distributed by SEI Investments Distribution Co., 1 Freedom Valley Dr. Oaks, PA 19456, which is not affiliated with the Advisor. Cambiar Funds are available to US investors only. Strategies included within the Separate Account section are not mutual funds and are not affiliated with SEI Investments Distribution Co.

*Quality and Valuation objectives analyzed when assessing individual portfolio companies are necessarily subjective and, therefore, may not be consistent with benchmark metrics, due to a number or factors including current investment sentiment, portfolio and benchmark composition, and other factors.

Definitions –

The Russell 2000® Index: measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconsitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.