Disruption: Software

The second part in our disruption series, we address the growth in software and cloud computing.

In 2011, venture capitalist Marc Andreesen first coined the phrase “Software is Eating the World”. While this statement is accurate, with all due respect to Mr. Andreesen perhaps this should have been restated as “Software Has Always been Eating the World”.

According to the Bureau of Economic Analysis, software spend has expanded its share of GDP by nearly 70% increasing from just 1.2% in 1998 to now close to 2% of US GDP. Going back further, in the 1960s software investments accounted for just 0.6% of total private fixed investment in the US whereas today software spend accounts for nearly 15% of total private fixed investment. There are a number of reasons behind this. In our first piece of the Disruptors series, we spoke about the impact from Moore’s Law on the adoption of various products and services. Clearly software adoption has benefited from a rise in processing power at lower prices which means software can do more to automate and accelerate tasks at the same cost each year. Additionally, as developed market labor forces age and retire, the resulting demographic shortage with respect to skilled labor has and will put more pressure on companies to automate more tasks through the use of software. Furthermore, with the adoption of smartphones especially in emerging markets, more users have access to the mobile internet today than any time in history allowing for software to reach all parts of the planet efficiently and effectively. Finally, one of the more recent factors driving this greater adoption of software has been due to the growing adoption of cloud computing by companies around the world.

Cloud computing is also sometimes referred to as distributed computing. While this seems revolutionary from the perspective of software consumption and delivery, in fact this concept goes back 150 years or more to the days of Thomas Edison and the first electric power plants. Prior to then, most power was generated at the location where it was consumed using localized power generators that consumed coal or gas. While functional, these localized systems were highly inefficient in their consumption of fossil fuels. As the demand for electricity outstripped the supply of natural resources, power plants began to emerge as a way of efficiently distributing power across large distances and in a scalable fashion. Much like then, today Amazon AWS and Microsoft Azure can be analogous to those early power plants of their time. Today companies can “rent” compute power based on their use with the flexibility to scale up and down their usage hourly and as needed, without having to invest significant sums of capital into on-premise data centers, servers, storage, etc.

Cloud computing is also sometimes referred to as distributed computing. While this seems revolutionary from the perspective of software consumption and delivery, in fact this concept goes back 150 years or more to the days of Thomas Edison and the first electric power plants. Prior to then, most power was generated at the location where it was consumed using localized power generators that consumed coal or gas. While functional, these localized systems were highly inefficient in their consumption of fossil fuels. As the demand for electricity outstripped the supply of natural resources, power plants began to emerge as a way of efficiently distributing power across large distances and in a scalable fashion. Much like then, today Amazon AWS and Microsoft Azure can be analogous to those early power plants of their time. Today companies can “rent” compute power based on their use with the flexibility to scale up and down their usage hourly and as needed, without having to invest significant sums of capital into on-premise data centers, servers, storage, etc.

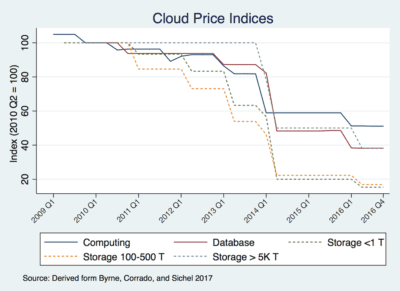

One of the other major benefits of this migration of computing workloads into the cloud is the significantly lower costs of computing power using the cloud. Depending on the service used, cloud pricing has fallen anywhere between 60%-90% over the past 10 years and should only continue to fall over time accruing to operational savings for clients. (Source: Byrne, Corrado and Sichel 2017)

This decline has largely come at the expense of components, hardware and physical infrastructure. As the landscape of buyers has shifted from hundreds of thousands of corporations around the world to now just a handful of very large cloud vendors (called hyperscalers) with immense scale, so too has the bargaining power over hardware and component vendors. The largest of these hyperscalers include Amazon AWS, Microsoft Azure, Google Cloud Partners and AliCloud run by Alibaba in China. As these hyperscalers procure and assemble much of the hardware and infrastructure themselves at ever cheaper prices, they’re consequently delivering meaningful savings on behalf of their corporate customers. Ironically rather than pocket these savings, companies are reinvesting this back into greater spend on software and IT services as corporations look to software as a means of transforming their businesses in a never-ending drive to become more competitive. Today only 20% of total workloads are performed in a shared cloud environment (source: McKinsey) and we believe this will only continue to move higher over time. As a result going forward, due to the scalability and cost savings brought about by distributed computing, we should continue to see an increasing share of IT services and software spend relative to global GDP.

One such example of a company benefitting from this trend is SAP. Founded in Weinheim Germany in 1972, SAP today has over 425,000 customers around the world across 180 countries. The company’s ERP software has been adopted by 92% of the Global 2000 companies and 85% of the 100 most valued brands. The company invented Enterprise Resource Planning (ERP) software which is the “plumbing system” for corporations. Today, SAP boasts the number one position with 25% global market share, nearly twice as large as the number 2 player. A full 77% of the world’s transactions touch an SAP system daily. While traditionally known as an on-premise software company, SAP has been on a 5-year transition towards the cloud. As of 2018, the company’s cloud revenues account for over 20% of group sales with over 200mm daily users of its cloud-enabled software services generating over EU5bln in annual revenues and grew 37% year over year. In fact, in 2018 for the first time in the company’s history, SAP’s cloud revenues surpassed its legacy on-premise software license revenues. Based on the company’s 2023 ambitions, SAP plans to grow its cloud-related revenues to EU15bln and account for nearly half of the company’s combined revenues. (source: SAP 2018 Capital Markets Day Presentation and Factsheet)

Though still in the early innings, we believe the ongoing shift into cloud creates tailwinds for software and IT spend. We feel this area of the market remains structurally attractive to invest capital for our clients.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.