Operating From Strength

SMID and Small Cap Value PMs Andy Baumbusch and Colin Dunn sit down with Value Investors Insight and detail why investors shouldn’t have to choose between value and growth.

For Investment Professional Use Only. Please fill out the form below to verify and access download.

[gravityform id=”9″ title=”false” description=”false” ajax=”true”]

ADDITIONAL INFORMATION

| Performance (ending 6.30.2021) | |||||||

| 2Q21 | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Cambiar SMID Value (g) | 4.9% | 21.8% | 60.2% | 18.8% | 18.6% | 13.4% | 16.1% |

| Cambiar SMID Value (n) | 4.7% | 21.4% | 59.3% | 18.1% | 17.9% | 12.7% | 15.3% |

| Russell 2500 Value | 5.0% | 22.7% | 63.2% | 10.6% | 12.3% | 10.9% | 12.3% |

Inception Date: 7.31.2010. The performance information depicted above represents Cambiar’s SMID Value Composite. Returns are presented gross (g) and net (n) of management fees. The composite contains accounts with gross and “pure” gross performance. Gross returns are reduced by transaction costs. “Pure” gross returns do not reflect the deduction of any expenses, including transaction costs. “Pure” gross returns are applicable to separately managed accounts that are part of broker-affiliated or broker-sponsored programs, including wrap programs, that waive commission costs or bundle fees including commissions (SMAs). “Pure” gross returns are supplemental information. Net returns are reduced by transaction costs and actual investment advisory fees and other expenses that may be incurred in the management of the account. SMAs often incur bundled fees, charged by the wrap sponsor or affiliated broker, that may include transaction costs, investment management, portfolio monitoring, consulting services, and custody fees. Net returns for SMAs are calculated by deducting the investment advisory fees from the client’s account as reported by the wrap sponsor or affiliated broker, or as received by Cambiar. Cambiar clients may incur actual fee rates that are greater or less than the rate reflected in this performance summary. Fees will vary based on the assets in the accounts. Returns are reported in U.S. dollars.

Performance results for the SMID Value Composite are evaluated against the Russell 2500™ Value Index. The Russell 2500 Value Index is a float-adjusted, market capitalization-weighted index comprised of firms in the Russell 2500™ Index that experience lower price-to-book ratios and lower forecasted growth values. The Russell 2500 Index is a float-adjusted, market capitalization-weighted index that measures the performance of the 2,500 smallest companies in the Russell 3000® Index, which consists of 3,000 of the largest U.S. equities. The index assumes no management, custody, transaction or other expenses. The Russell 2500 Value Index is a broadly based index that reflects the overall market performance and Cambiar’s returns may not be correlated to the index. The index is unmanaged and one cannot invest directly in an index. Cambiar’s performance and the performance of the Russell 2500 Value Index include the reinvestment of all income. Performance is preliminary; please contact us for finalized figures. As with any investments, there are risks to be considered. Past performance is no indication of future results.

| Performance (ending 6.30.2021) | |||||||

| 2Q21 | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |

| Cambiar Small Cap Value (g) | 3.4% | 17.6% | 51.2% | 13.1% | 13.9% | 9.7% | 10.8% |

| Cambiar Small Cap Value (n) | 3.2% | 17.1% | 50.0% | 12.1% | 12.9% | 8.7% | 9.7% |

| Russell 2000 Value | 4.6% | 26.7% | 73.3% | 10.3% | 13.6% | 10.9% | 8.2% |

Inception Date: 11.30.2004. The performance information depicted above represents Cambiar’s Small Cap Value Composite (Institutional). Returns are presented gross (g) and net (n) of management fees. From 2014 to present, the composite contains accounts with only gross performance. Prior to 2014, the gross returns reflect accounts with both gross and “pure” gross performance. Gross returns are reduced by transaction costs. “Pure” gross returns do not reflect the deduction of any expenses, including transaction costs. “Pure” gross returns are applicable to separately managed accounts that are part of broker-affiliated or broker-sponsored programs, including wrap programs, that waive commission costs or bundle fees including commissions (SMAs). “Pure” gross returns are supplemental information. Net returns are reduced by transaction costs and actual investment advisory fees and other expenses that may be incurred in the management of the account. SMAs often incur bundled fees, charged by the wrap sponsor or affiliated broker, that may include transaction costs, investment management, portfolio monitoring, consulting services, and custody fees. Net returns for SMAs are calculated by deducting the investment advisory fees from the client’s account as reported by the wrap sponsor or affiliated broker, or as received by Cambiar. Cambiar clients may incur actual fee rates that are greater or less than the rate reflected in this performance summary. Fees will vary based on the assets in the accounts. Returns are reported in U.S. dollars.

Performance results for the Small Cap Value Composite (Institutional) are evaluated against the Russell 2000® Value Index. The Russell 2000 Value Index is a float-adjusted, market capitalization-weighted index comprised of firms in the Russell 2000® Index that experience lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Index is a float-adjusted, market capitalization-weighted index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which consists of 3,000 of the largest U.S. equities. The index assumes no management, custody, transaction or other expenses. The Russell 2000 Value Index is a broadly based index that reflects the overall market performance and Cambiar’s returns may not be correlated to the index. The index is unmanaged and one cannot invest directly in an index. Cambiar’s performance and the performance of the Russell 2000 Value Index include the reinvestment of all income. Performance is preliminary; please contact us for finalized figures. As with any investments, there are risks to be considered. Past performance is no indication of future results.

Performance presented is intended for institutional client use only. For more information, please access our GIPS Reports here.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.

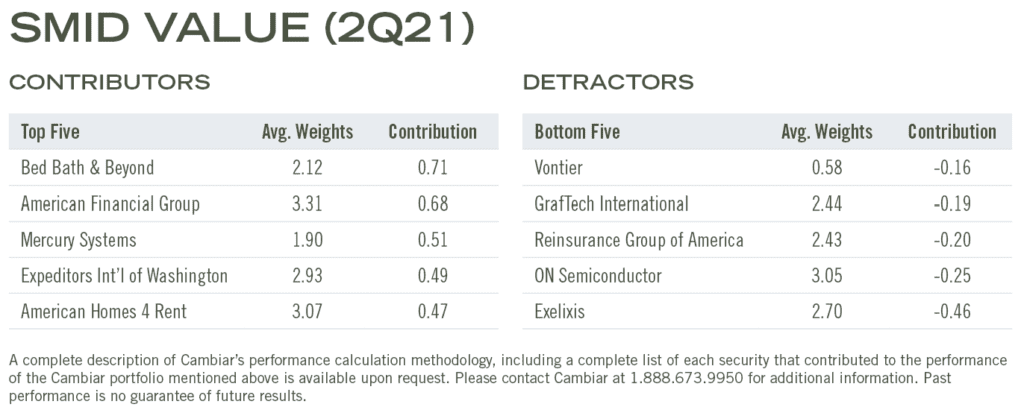

The specific securities identified and described do not represent all of the securities purchased or held in Cambiar accounts on the date of publication, and the reader should not assume that investments in the securities identified and discussed were or will be profitable. The holdings described may differ by account based on the account’s strategy, and other factors. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned.