Post Thanksgiving Indigestion 2021

The week of Thanksgiving has historically been a peaceful lull for investors. Staying true to 2021, events around the holiday were far from normal.

Key Takeaways:

-

COVID variants are likely to evolve to more transmissible and less-lethal mutations (similar to other viruses). In the meantime, trading stocks around will be difficult. They will just react.

-

Possibly overly concerned by past inflation target undershooting, the Fed’s message was an intention to overshoot.

-

The mounting evidence of excess inflation and bubble asset prices and a no-longer politically constrained Fed Chairman may be the real cause of post-Thanksgiving indigestion.

Growing up, Thanksgiving always seemed to me to be the quintessential American holiday.

This observation was less about feeling affinity for the Pilgrims who landed at Plymouth Rock. Thanksgiving was the one and only holiday that my disparate relatives around the state and the country would actually travel somewhere for. Perhaps my relatives felt some obligation to attend some common social function at least once a year. Perhaps among the other possible collective social dates, Thanksgiving was safer because a television could reliably be expected to be tuned to football during and through the entire pre-dining social hour, providing a safe distraction from any number of possibly challenging intra-family encounters. Perhaps it was as simple as being the one holiday where my Grandmother, a domineering woman with a remarkable willingness to throw shade at her progeny and their spouses in a very public way, tended to be in an uncharacteristically good mood. Though a Denver native and lifetime Broncos fan, her true sports love always seemed to be the Dallas Cowboys, whose annual Thanksgiving Day game is as close to a holiday staple as pumpkin pie.

Then again, perhaps Thanksgiving is quintessentially American because we give thanks in some non-denominational way, and then as the tradition would have it, demonstrate said thankfulness by gorging ourselves into a food coma, with nary a salad or vegetable plate to be found amidst the colorful multi-course barrage of heavy, carby foods. And this is just the kick-off for a whole season of excess consumption that runs for another five weeks, of course. How could anything be more American than that?

Most years, investment managers can at least rely on Thanksgiving week for a peaceful lull to the news cycle and stock market churn that otherwise dominates our lives.

As luck would have it, 2021 isn’t most years. While investors can be thankful for an exuberant stock market that has blunted the severity of life under COVID for the last ~20 months, eventually, something was going to change the narrative.

Enter a new variant of COVID and a new Federal Reserve framework, oddly timed for the quietest week of the year.

THOUGHTS ON THE

OMICRON VARIANT

Our view has been that with vaccines and soon-to-be-available antivirals that slow down viral replication, investors ought not to fear sustained business disruption well into 2022.

The sardonic tone above is intended to instill some skepticism in the reader about the curiously timed Omicron variant news drip late on Thanksgiving evening and hours before the single lightest day of equity trading of the year. Almost two full years after “two weeks to flatten the curve,” lockdowns and acute economic disruptions out of abundances of caution, a series of Greek letter named variants of the original COVID virus – of which none previously elicited a response in overnight equity index futures – suddenly lockdowns, travel bans, and a fresh round of other medical necessities are on the table?

Officially, we just don’t know enough to make specific predictions. Officially. But we suspect that the more mutated Omicron variant may have traded some of its predecessors’ lethality for improved infectiousness. COVID-19 represents a rarity in the world of viruses, one that is both lethal to a large percentage of the infected and easily transmissible. Usually, viruses are highly contagious but not very dangerous, such as the common cold, or are very lethal but unable to survive out in the open air, such as Ebola. The seasonal flu of 2021 is a distant relative of the infamous and very deadly Spanish Flu of 1918. The flu virus mutated and evolved – because this is what viruses do – and in so doing became more transmissible and yet less lethal. In evolutionary biology terms, this is what the virus should do.

This… is probably the path of COVID-19. More will be learned soon and it will likely be impossible to trade stocks around it. They will just… react.

For what it’s worth, travel-related stocks, aircraft producers, hoteliers, and a large cache of stocks across the capitalization spectrum gave up 10%-20% of their value between the end of Thanksgiving dinner and December 1st. Most of these reopening stocks had apocalyptic earnings performances in 2020, and operational performance remained compressed, though less so in 2021. Investors have valued them on some multiple of 2019 earnings, and have tended to presume a complete recovery back to these levels by 2023. Based on the rapid discounting, the entirety of the 2022 earnings recovery would seem to have been pushed out at least a year by Omicron. Cambiar holds a good number of positions tied to a complete economic reopening in some capacity. The post-Thanksgiving reaction has been damaging to these, but we are generally sitting tight. Our view has been that with vaccines and soon-to-be-available antivirals that slow down viral replication, investors ought not to fear sustained business disruption well into 2022. If we learn that the disease severity is not as pronounced as Delta and other previous variants, heightened transmissibility could paradoxically hasten a full return to normalcy as societies reach herd immunity more rapidly. That is a wild conjecture as of early December but at least worth thinking about, versus full-year implied downgrades of reopening stock earnings.

Speaking not as a financial professional, but as somebody who does enjoy living life – if somehow Omicron is even more infectious and mutated away from what the current crop of vaccines are engineered to combat, such that full-scale lockdowns and vaccine prioritization schemes are again pursued while we await a fresh batch of RNA strands…I am not sure democratic societies will be prepared to do this again. I am fairly certain I am not prepared to do this again. Maybe this is the message of the last week. The potential for another round of COVID-driven isolation may uncork something very dangerous. These rather plausible tail risks may be the real message. Or maybe it’s just the prospect of a more restrictive Fed.

THE FED RETIRES “TRANSITORY”

Just a couple of days before Thanksgiving, President Biden re-nominated Jerome Powell for a second term as Fed Chair in 2022. This could have happened weeks or months earlier, but Biden seemed to want to explore other possibilities. Perhaps sensing that a confirmation battle for a new Fed Chair would be a poor use of political capital, a second term sidesteps this issue. It also frees Powell to get on with the business of managing monetary policy, which may be quite a task given the Fed’s overly broad Pandemic framework. Sheriff Powell replaces circus maestro Powell.

Early in the Pandemic, the Fed adopted a new acronym to describe their monetary policy framework: FAIT, or Flexible Average Inflation Targeting. Having undershot their 2% inflation target for most of the 2010-2019 time period, and with deflationary forces seemingly a risk due to COVID lockdowns, business failures, and consumer struggles, hyper-aggressive monetary policy was dialed up. Possibly overly concerned by past inflation target undershooting, the Fed’s message was an intention to overshoot, potentially materially, so as to provide some reserve cushion for potential future undershooting of the 2% target. FAIT’s message for bond investors was not to worry about an overshoot, leading to tightening, because some inflation could be expected upon reopening a closed global supply chain. This is all part of a model based on U.S. de-mobilization after the second World War. Hence, “transitory inflation.” All well intended, but to many investors and economists, this has seemed vague and overly broad versus the Fed’s conventional dual mandate, inviting a policy overshoot or error in some form.

With the backdrop of the near-global depression that followed the 2008 global financial crisis, and the disastrous circumstances of the early 2020 lockdowns, a hyper–normal monetary injection into the economy was understandable. However, unlike 2008, the monetary transmission mechanisms of the banking and securities markets continued to function very smoothly. High capital requirements and conservative lending standards forced upon the banks via Dodd-Frank and BIS standards worked. The net result has been consumers flush with cash, businesses benefiting from the easiest borrowing conditions on record, and across the board inflation that does not seem especially transitory.

The Fed has increased its balance sheet from $3.7 trillion to $8.7 trillion, leading to enormous money supply growth…

A breakout in inflation

And yet the lowest corporate bond spreads since 2007…

And the lowest high yield spreads on record for most of 2021…

This correlates with asset price inflation and speculation. Without getting into the litany of asset prices that have inflated, median home prices have moved up nationally from a stable 3-4x median income level to 5-6x in 2021. This happened once before, in 2007. For the Russell 2000 Index, a record 45% of the ~2000 stocks do not earn money. This is in the context of a year with record corporate earnings as a % of GDP. Again, not a good formula.

The public statements from the Federal Reserve Board of Governors, since early November, have shifted from downplaying any talks of the possibility of rate hikes in 2022 to accelerating the taper of bond purchases, such that the Fed can be entirely out of the bond-buying business by the end of March, leaving the door wide open to rate hikes in May or June. Chairman Powell had been relatively quieter before renomination, though he had begun to at least acknowledge that the term “transitory” to describe inflationary pressure caused by excess liquidity and damaged supply chains has become a bit of a misnomer. In early December, he “retired” the term, which is code for recognizing that FAIT and the whole de-mobilization model may be flawed in the face of clear supply chain challenges that the Fed has limited powers to remedy.

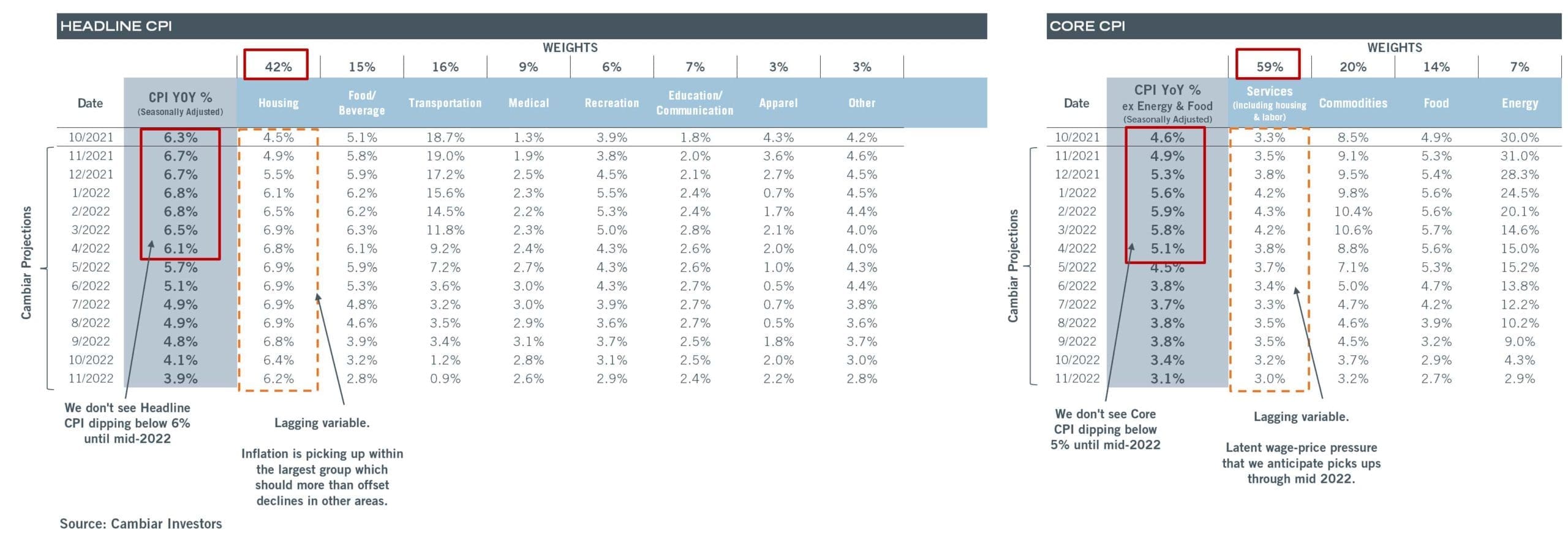

Our in-house economic stats guru Adam Ballantyne has been building an inflation model from the ground up since the beginning of the Pandemic. Frankly, his estimates have tended to be more accurate than a lot of external forecasters. We are presenting both sets of his models, headline and core, for your interest. The most important variable to focus on is the weight of housing, which is 42% of the inflation basket. Housing is generally a lagged variable because of the odd way it is calculated. Obviously, only a small percentage of homes trade in a given year, so the input calculates the change in what a homeowner would demand if he or she were to rent their home out, as compared to a year earlier. Net, despite explosive home price gains from early 2020 to now, the housing variable is just now starting to ramp up in the calculation. Add some gains from the other two big components driving the headline calculation (food/beverage and transportation) with the latter impinging on the former, and we don’t see the CPI falling below 6% until mid-2022. The “core” CPI excludes food and energy costs and thus weights up services. Given latent wage-price pressure in these, we don’t see core CPI below 5% until well into 2022. At this point, these numbers are more or less baked into the cake.

FAIT ACCOMPLI

We doubt the Fed will simply drop the FAIT framework just 1.5 years after initiation. However, if the goal is 2% long-term inflation by slightly overshooting as we exit the Pandemic, with 5% and 4% core CPI almost baked in for 2021 and 2022, inflation would need to average less than 1.4% annually for the remainder of the decade to average 2.0% for the whole decade. This seems implausible. FAIT has already blown through its inflation-overshoot budget.

The pre-FAIT Fed worked with a dual mandate to focus on price stability and maximum employment. It’s worth pointing out that a third objective, asset price stability, was openly discussed by many in the wake of the 2000 stock market crash and shallow recession, and especially in the wake of the 2008 financial crash and severe recession. These recessions were caused not by conventional business cycle exhaustion, but by dangerous asset bubbles.

Understandably in the shadow of a 33% economic contraction in early 2020, asset bubbles were the least of anybody’s concerns, and the Fed was correct to err on the side of excess liquidity and credit support in a big way. But with the economy already well past pre-COVID economic activity by mid-2021, and mounting evidence of asset price spirals alongside the tradable goods price spiral that should accelerate into early 2022, we believe Fed policy looks out of touch.

The mounting evidence of excess inflation and bubble asset prices and a no longer politically constrained Fed Chairman may be the real cause of post-Thanksgiving indigestion. The usually reliable “Fed put” on stock market carnage may not be in play until inflation readings settle down. Our visibility on this is limited beyond 2022. For the moment, more speculative business models and stocks over-earning from the liquidity gusher of 2020-2021 seem vulnerable.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.

The specific securities identified and described do not represent all of the securities purchased or held in Cambiar accounts on the date of publication, and the reader should not assume that investments in the securities identified and discussed were or will be profitable. All information is provided for informational purposes only and should not be deemed as a recommendation to buy the securities mentioned.