The Importance of Quality Following Interest Rate Hikes

As inflation levels remain elevated, the Federal Reserve has responded by raising the cost of capital. Cambiar examines the benefits of owning quality in past periods of tightening liquidity conditions.

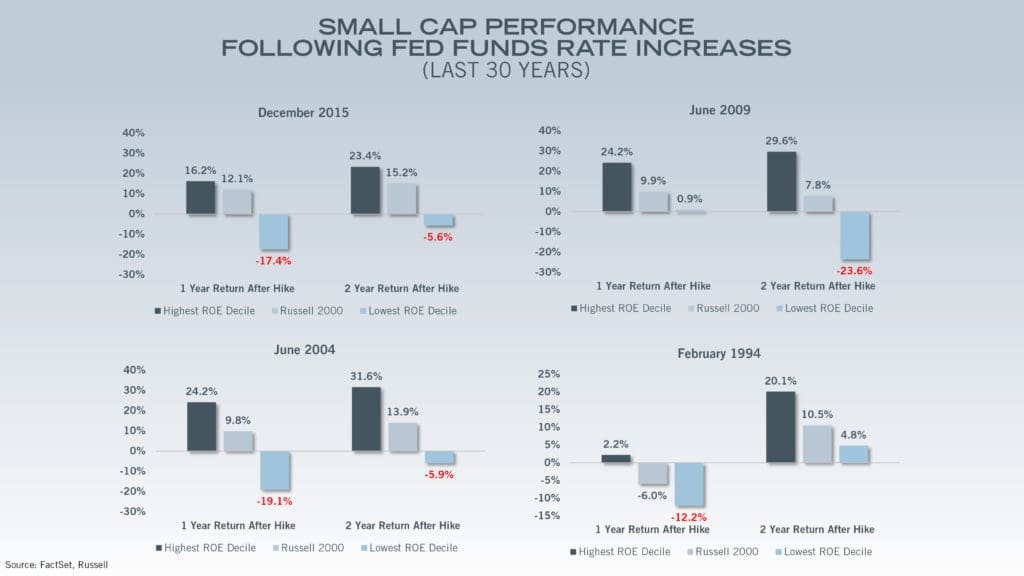

With market participants continuing to digest the current CPI figures and the likelihood of another 75-bp rate hike at the next Fed meeting, we look back to evaluate how smaller cap stocks have performed in previous rising interest rate cycles.

It is Cambiar’s view that attaching to quality businesses can assist in providing strong risk-adjusted returns on a through-the-cycle basis, but should be even more consequential to success in periods of tightening monetary policy. This is confirmed in the data; generally speaking, when rates rise, so does the importance of investing in high-quality companies with strong operating metrics that can weather the higher cost of capital.

As illustrated below, the highest ROE companies within the Russell 2000 significantly outperformed the lowest ROE decile over a forward 1-2 year timeframe following Fed-induced rate hikes.

Active Management in Small and Midcaps

Cambiar believes that active management with a bias towards quality businesses can provide excess returns over a market cycle, particularly in less efficient areas of the equity market such as the small and mid-cap asset classes. Selective avoidance of unprofitable and/or highly leveraged businesses should also assist in providing downside protection in more volatile market environments.

We invite you to learn more about our investment offerings.

Certain information contained in this communication constitutes “forward-looking statements”, which are based on Cambiar’s beliefs, as well as certain assumptions concerning future events, using information currently available to Cambiar. Due to market risk and uncertainties, actual events, results or performance may differ materially from that reflected or contemplated in such forward-looking statements. The information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or endorsement to buy or sell any security, investment, or portfolio allocation.

Any characteristics included are for illustrative purposes and accordingly, no assumptions or comparisons should be made based upon these ratios. Statistics/charts and other information presented may be based upon third-party sources that are deemed reliable; however, Cambiar does not guarantee its accuracy or completeness. As with any investments, there are risks to be considered. Past performance is no indication of future results. All material is provided for informational purposes only and there is no guarantee that any opinions expressed herein will be valid beyond the date of this communication.